Residential depreciation calculator

Uses mid month convention and straight-line depreciation for recovery periods of 22 275 315 39 or 40 years. IRS forms 1120 1120S or 1065 in which you have an interest.

Accounting Journal Excel Template Download This Accounting Journal Excel Template And After Down Bookkeeping Templates Excel Templates Book Keeping Templates

This depreciation calculator will determine the actual cash value of your Refrigerator using a replacement value and a 15-year lifespan which equates to 015 annual depreciation.

. Changes in 2020 reintroduce depreciation deductions for non-residential buildings for the 2021 and subsequent income years. The macrs depreciation calculator is specifically designed to calculate how fast the value of an asset decreases over time. Find out the effective life and depreciation rate for any residential or commercial plant and equipment asset.

Calculate depreciation used for any full year and create a depreciation schedule that uses mid month convention and straight-line depreciation for residential rental or nonresidential real property related to IRS form 4562 lines 19 and 20. BMT Construction Cost Calculator. Call Us Today 1300 990 612.

Depreciation is a tax deduction available to property investors. BMT Tax Depreciation Calculator. Basically it recognises that the building itself plus its internal furnishings and fittings will become worn over time and eventually need to be replaced.

They agreed that only improvements and replacements to plant and. Remember that residential rental property is depreciated at a rate of 3636 percent per year for 275 years. If you have a question about the calculator and what it does or does not support feel free to ask it in the comment section on this page.

The math is a bit more complex than well want to dive into here but to get a ballpark of your expenses you can enter the cost of your property and other variables into a property depreciation. You should also examine each partnership or corporation eg. Section 179 deduction dollar limits.

For residential household and personal items lifespan will vary depending on the quality of materials and workmanship frequency of use or misuse storage. Available online or as an app for iPhone iPad and Android phone or tablets for use anytime anywhere the BMT Tax Depreciation Calculator is an indispensable tool for anyone involved in property investing. BMT Construction Cost Calculator.

For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000. Well you can use this tool to compare three different models of macrs depreciation that are the 200 declining balance 150 declining balance and straight-line method over a GDS Recovery. The Depreciation Calculator computes the value of an item based its age and replacement value.

Both new and old residential investment properties have substantial depreciable value. Washington Brown are Quantity Surveyors in Australia providing expert Depreciation Schedules and a FREE tax depreciation calculator - Try Now. Property depreciation for real estate related to.

Then it automatically calculates depreciation for either residential or commercial rental properties based on the users choice. This depreciation calculator is for those that need to calculate a depreciation schedule for a depreciating asset such as an investment property. Depreciation on buildings Depreciation was allowed on most buildings until 2010 and for the 2012 2020 income years the depreciation rate for buildings with an estimated life of more than 50 years was set at zero.

Businessfarm income is normally found on Schedules C andor F. Of all the tax deductions available to property investors depreciation is the second largest deduction available after interest. Experts depicted that the value of the building only can be depreciated.

Find out the effective life and depreciation rate for any residential or commercial plant and equipment asset. It allows you to claim a tax deduction for the wear and tear over time on most old or new investment properties. Therefore according to the Australian tax law you can claim tax deductions on.

BMT Tax Depreciation Calculator. Sum-of-Years Digits Depreciation Calculator. MACRS Depreciation Calculator Help.

As the owner of a residential investment property claiming depreciation deductions can make a big difference to your cash flow. NW IR-6526 Washington DC 20224. The smart depreciation calculator that helps to calculate depreciation of an asset over a specified number of years also estimate car property depreciation.

A depreciation report on your Australian Residential property within 14 working days or well reduce the fee by 50. Above is the best source of help for the tax code. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

It will calculate straight line or declining method depreciation. For residential household and personal items lifespan will vary depending on the quality of materials and workmanship frequency of use or misuse storage. Use a Tax Depreciation Calculator.

The most common method of calculated depreciation the General Depreciation System spreads depreciation equally over a term of 275 years for residential buildings. To calculate your depreciation divide your property value by 275 and you get the amount of depreciation youre allowed to claim each year. We welcome your comments about this publication and suggestions for future editions.

You can browse through general categories of items or begin with a keyword search. Suppose you need to calculate the depreciation of your property. Immovable property of this nature.

10-year property 15-year property 20-year property 25-year property 275-year residential rental property and 39-year nonresidential real property. DepPro Depreciation Professionals property report investment property calculator investing in property tax depreciation property depreciation Melbourne. Our tool is renowned for its accuracy and provides usable figures and a genuine insight into the potential cash returns you could expect from an investment property.

Calculate depreciation and create a depreciation schedule for residential rental or nonresidential real property related to IRS form 4562. In terms of law real is in relation to land property and is different from personal property while estate means. Depreciation on an investment residential property cant the deducted from income tax.

The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2021 is 18200 if the special depreciation allowance applies or 10200 if the special depreciation allowance does not apply. You should include total business or farm net income before adjusting for depreciation andor losses. Real estate is property consisting of land and the buildings on it along with its natural resources such as crops minerals or water.

Estimate depreciation deductions for residential investment properties and commercial buildings. An interest vested in this also an item of real property more generally buildings or housing in general. The MACRS depreciation calculator adheres to US income tax code as found in IRS Publication 946 opens in new tab.

Depreciation limits on business vehicles. The MACRS Depreciation Calculator allows you to calculate depreciation schedule for depreciable property using Modified Accelerated Cost Recovery System MACRS. Estimate depreciation deductions for residential investment properties and commercial buildings.

In that case you should use an investment property depreciation calculator to get at least a general idea about the tax deductions you can claim in your tax return. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2700000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2022. For US tax filers.

Real Estate Property Depreciation Calculator.

Depreciation Of Property Definition Tips To Calculate A Complete Guide Real Estate Photography Real Estate Buying Real Estate

Untended Depreciation Schedule Sample Schedule Templates Schedule Schedule Template

10 Major Changes Our Schools Should Make Budgeting Accounting Services Business Loans

Meaningful Wednesday 𝐀𝐏𝐏𝐑𝐄𝐂𝐈𝐀𝐓𝐈𝐎𝐍 𝐎𝐑 𝐃𝐄𝐏𝐑𝐄𝐂𝐈𝐀𝐓𝐈𝐎𝐍 Abs Net Worth Meaningful

Inventories Office Com List Template Free Business Card Templates Business Template

What Is Bonus Depreciation In 2022 Tax Reduction Bonus Net Income

What Is A Property Depreciation Calculator It Helps You To Estimate The Likely Tax Depreciation Benefit Investing Investment Property Loan Repayment Schedule

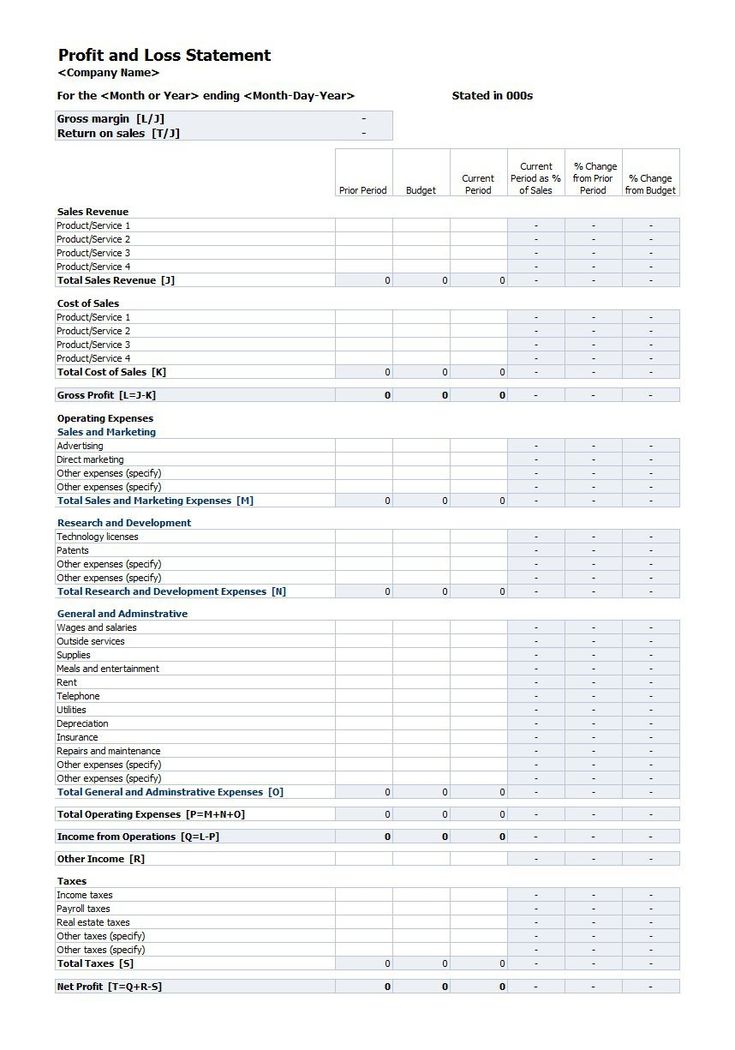

42 Profit And Loss Statement Template For Professional Business Reports Mous Syusa Profit And Loss Statement Statement Template Report Template

Rental Property Management Fee Tracker Etsy Rental Property Management Property Management Rental

Prabhupremgroup Believes In Building A House With Every Brick Of Trust Visit Us Http Www Prabhupremgro Building A New Home Attleborough Building A House

Meaningful Wednesday 𝐀𝐏𝐏𝐑𝐄𝐂𝐈𝐀𝐓𝐈𝐎𝐍 𝐎𝐑 𝐃𝐄𝐏𝐑𝐄𝐂𝐈𝐀𝐓𝐈𝐎𝐍 Abs Net Worth Meaningful

Hotel Profit And Loss In 2022 Profit And Loss Statement Excel Templates Statement Template

Freelance Weekly Printable Time Sheet Freelance Bar Graphs Printables

Expense And Profit Spreadsheet Profit And Loss Statement Statement Template Spreadsheet Template

How To Calculate Depreciation Expense For Business Online Accounting Software Accounting Books Business

Is A Cost Segregation Study Worth It Investing Study Being A Landlord

Projected Income Statement 5 Years On Existing Business Income Statement Business Planning Financial Planning